It is paradoxical that of the great 19th century economic thinkers, it is Henry George who has fallen most in fame while his ideas have best survived the test of time.

Born to a lower middle class family, he spent his adult life struggling economically until reaching his forties, when he published a book titled “Progress and Poverty”. The book sold millions of copies, more than any other book at the time, excluding the Bible. In the 1930s it was estimated that the book had a wider distribution than all other books on political economy combined.

The basic idea in the book was that the value of the land should be taxed. A 1% land value tax would mean that if you own a piece of land worth of 100$, you would have to pay 1$ each year. Taxation of real estate in most countries does include this element, but it only makes up a small share of tax revenue, except in a few countries, such as Hong Kong and Singapore. To this day, there is no tax more popular among economists from left to right than land value tax. Below are some reasons why this is.

Five reason why land value tax is the perfect tax

- It is impossible to avoid

It is impossible to avoid and easy to collect. Land can’t be moved offshore or hidden in brown envelopes. - It does not reduce the supply of land

The supply of land is fixed, no matter how much it is taxed. If you tax alcohol, the price goes up, demand is reduced and supply is reduced as a result. If you tax land, the amount of land is not reduced. - It is taxing unearned increments

Value of the land (in urban settings) is determined by its location. The value is not the result of the landowners actions, but due to the surrounding community. If you own a piece of land, and a bus stop is built next to it, the value of the land is increased. However, the landowner has not done anything to cause the increase the value of the land.

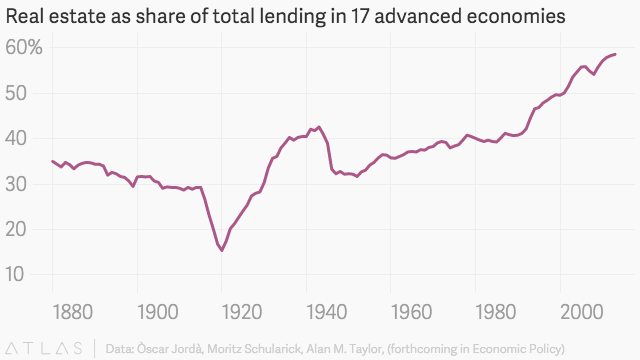

Increasing share of bank lending is towards real estate, with the share of business lending decreasing. This is a sign of the economic system moving from productive activities towards rent-seeking.

- It can not be shifted to the tenants

A shopkeeper can shift a tax on alcohol onto customers by increasing the price of the alcohol and holding on to his storage of alcohol, as the tax is only paid once the alcohol is sold. If a landlord tries to shift a land value tax onto tenants by holding out for higher rent, the tax is still paid in the meantime, although there is no rental income with which to pay it. So the tax increases the pressure on the landlord to find a tenant, and in order to attract a tenant the landowner is pressured to lower rather than increase the rent.

As mentioned earlier, land is fixed in its supply. The price is fully determined by demand – the landlords are already charging as much as they can not to lose their tenant. This explains also why it can’t be passed to tenants. If they could charge more without losing the tenant, they already would, regardless of the tax. Land value tax would just mean that larger share of what they charge goes to public coffers, not the landowner. - It is progressive

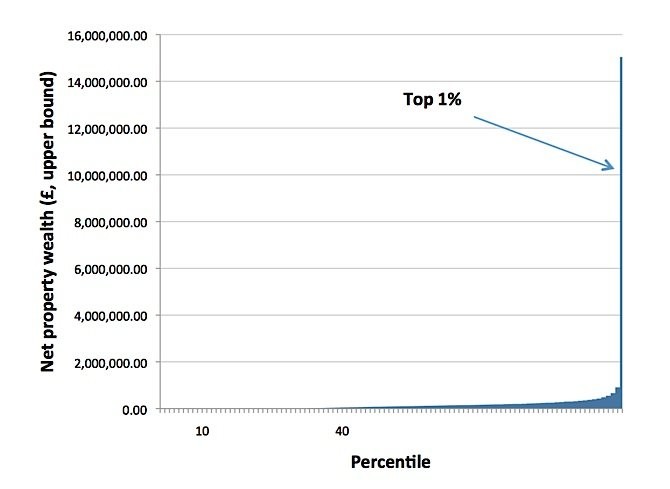

Land ownership, especially that of urban land, is one of the main factors driving inequality. Half of England is owned by less than 1% of the population. This inequality is becoming increasingly important as the value of the land relative to the GDP is growing. In 1977 the value of land and dwellings was 50% of the UK GDP. It now stands at more than 200%.

The picture below shows the inequality of property ownership in the UK. Most of the property value is in the land.

Commons and the land value tax

Value of the land is collectively produced by the community surrounding the land and this is what makes the location as valuable as it is. Yet it is privatized, with only the landowner being able to reap the benefits. This is the opposite of the commons, where, for example, an open-source software program might be produced by a single person, yet it can be used by everyone. It would therefore make sense for land value to be used to fund the commons, whether that means open-source software, open-access research, inventions that are patent free, culture that is available under creative commons, etc.

Let’s tax value that is produced by everyone but enjoyed by only a few so we can fund things that are produced by a few but enjoyed by everyone.

Limited equity housing cooperatives

Housing cooperatives are housing units owned democratically as a cooperative by the tenants. There are two basic types of housing cooperatives, limited equity and market based. In a limited equity housing cooperative, the tenant is allowed to buy the apartment (and therefore a membership in the cooperative) for an affordable price, but in return, is only allowed to sell the apartment at an affordable price, typically only being allowed to charge for the improvements. In a market priced housing cooperative, the tenant buys and sells the apartment for a market price.

Limited equity housing cooperatives used to play a major role in Norway and Sweden. The labour movement used the model to provide affordable housing during a period of rapid urbanisation. However, beginning in the late1960s, the tenants grew increasingly hostile towards the model. They could see their neighbours who didn’t live in a housing cooperative sell their apartments for a price much higher than they could. As urbanisation had progressed, the value of the tenants apartments had grown, yet they had to sell the apartment for an affordable price. Getting rid of the limited equity model and allowing the tenants to sell their apartments for a market price was a key factor in shifting the tenants from the social democratic parties towards the right wing parties, starting the decline of the dominance that the social democratic parties had played in the countries elections.

Had there been a strong land value tax that would have taxed away the unearned increments of the land value, the pressure from the tenants to move away from the limited equity model would have been reduced. It would be a subject worth of researching to see whether the tenants in housing units that had seen highest increases in land value were also the ones most likely to oppose the limited equity model.

Towards a new economic paradigm

After the 1930s financial crisis, a new economic paradigm of Keynesian social democracy emerged, largely agreed upon by both the left and the right. After the late 1960s unrest and the early 1970s oil shock, it was replaced by a new economic paradigm of neoliberalism, that also became widely adopted across the political spectrum.

As economic thinking is starting to adjust to explain what went so horribly wrong during the 2008 financial crisis, there is a demand for a new economic paradigm – a framework that both the left and the right can agree upon to work

within.

Two components of the new economic paradigm might be the following:

1. Shifting the taxation from transactions between buyers and sellers towards rentiers.

The majority of the tax revenue in most countries is collected by taxing transactions between buyers and sellers; whether it is the value added tax paid when someone buys something from a shopkeeper, or the income tax that a shopkeeper pays when it buys labour from its employees. Taxation could be shifted instead towards rentiers. The mother of all rentiers is the landowner, but there are also other forms of rentiers, such as those who own natural resources.

2. Dismantling the conflict of interest between buyers and sellers with stakeholder ownership.

Perhaps the most fundamental conflict of interest in the economic system is between buyers and sellers. When an employer buys labour from an employee, it is in the interest of the employee to be paid as much as possible and for the employer to pay as little as possible. The way to dismantle this conflict of interest is to make buyers into sellers through stakeholder ownership. If the customers own the stores they shop in, such as in the case of consumer owned retail cooperatives, there is no conflict of interest – the customers own the shop, so there is no incentive for them to charge themselves any more than is necessary. If the employees own the company, such as in a shareholder company where the shares are owned by the employees or in a worker owned cooperative, there is no incentive for the workers to pay as little to themselves as possible.

This could be an economic system where the power of rentiers and monopolists would be reduced in a way that produces more technology, science and culture, accessible to all. It would be a society where you would earn your money in a company you own, save it in a bank account in a credit union you own and use it to buy goods from a retail cooperative you own. It could appeal to those on the right, as work and entrepreneurship would be taxed less and more people would be business owners. It could appeal to those on the left, as ownership would be more equally distributed, and the means of production and distribution would be owned democratically by the workers and the customers, instead of a small economic elite.