When people think about digital currency, the first thing to come to mind may be bitcoin, cryptocurrencies, or blockchain. However, digital currency and other virtual representations of money have existed as far back as the 19th century in the USA.

In 1871, Western Union created the very first money wire transfer service using the telegraph. It made possible for robber barons to move their money across the country in the form of a virtual representation of money. Now they didn’t need to rely solely on physically storing and moving their money.

This was a huge disruption in the financial world as moving money through electricity in wires was exponentially quicker compared to moving physical assets. The conception of money and what it represents moved from being a purely scarce physical commodity to sometimes one that could also be represented through electricity. The invention of the money wire transfer also came in time for the first Gilded Age in America, a time known for its excess of wealth for industrialists and abject poverty for their workers.

To make a long story short, as most things over time, ways to transfer value between people or accounts evolved with the latest technologies that could reduce the process time and increase the ease at which people could do it. In the 1970s three interesting things happened in the world of finance:

- The beginning of neoliberal economic policy largely in the US and the UK in the form of banking deregulation

- Credit cards were pushed at an increasing rate to make it easier for people to buy things they otherwise could not afford

- A network of banks in California started the first automated clearing house (ACH) which processes large volumes of credit and debit transactions in batches using computers, a huge improvement from telegraphs

All of the ingredients were now in place for the financialization of many aspects of our lives because buying things was easy and fun now! In order to facilitate the increased financial complexity that these policies brought, computer databases were used to automate financial activity, especially as a way to keep track of the debts people owed now that credit was easier to get. In the neoliberal’s mind, this was a good idea because all of the new wealth that the rich would make off of the new pro-business policies would “trickle down” onto the middle class. There is little evidence to believe that the strategy has worked in that way.

This shows that digital currency (the representation of monetary value using digital technologies) has actually existed for quite some time in centralized databases. For the internet age, it was only a matter of putting these databases online. In fact, the first financial institution in the world to provide online banking was a credit union. The second financial institution in the world and the first in Europe to have online banking was a cooperative, the Finnish OP Ryhmä. Although most people might associate digital currency with bitcoin and other cryptocurrencies, the only thing we can call these representations of money held at banks and payment processing companies is digital currency.

The first attempt at electronic cash over the internet was DigiCash, founded by David Chaum (one of the original cypherpunks) in 1990 based on his own 1983 research paper. Interestingly, it detailed a protocol with every proposed element of the bitcoin blockchain except for Poof of Work but did not experience the same success as bitcoin. Part of the reason why it didn’t reach the same success is that DigiCash did not have the same properties as cash. Based on the technical specifications of DigiCash, a user had to trust the company would follow through on their transaction which is very unlike cash. When I give you cash, we are the only two needed to make the transaction happen. This makes cash peer-to-peer where DigiCash was an electronic form of money reliant on their data servers to transmit the value behind the currency.

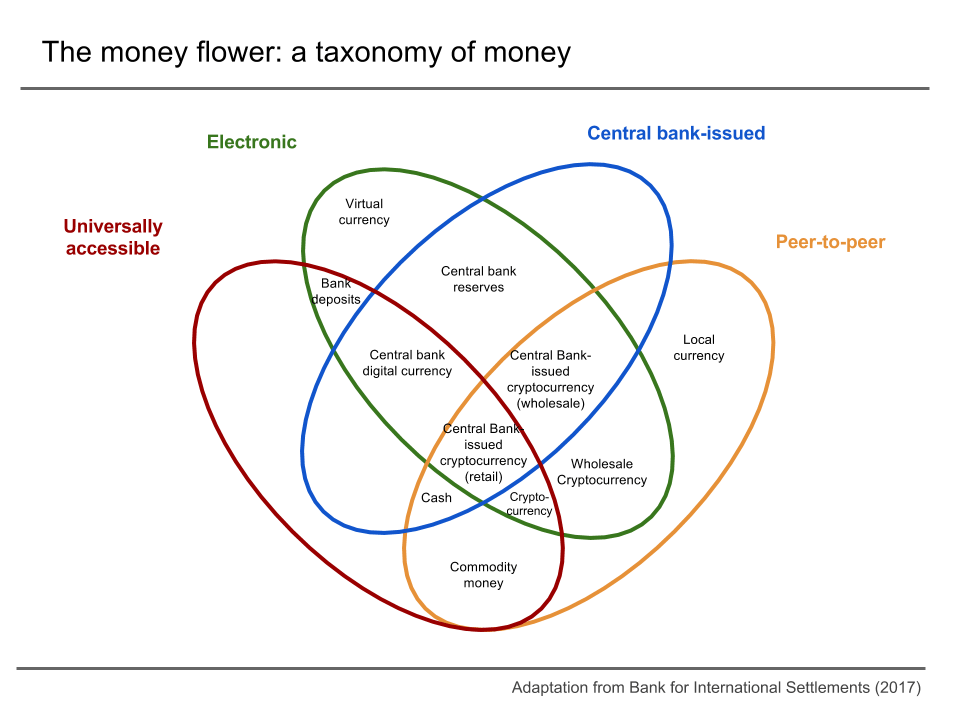

Taxonomy of money, based on “Central bank cryptocurrencies” by Morten Linnemann Bech and Rodney Garratt (Creative Commons)

In late 2007, the US subprime mortgage market collapsed and brought down with it banks around the world causing the Great Recession, the most severe economic and financial meltdown since the Great Depression. It was a period defined by a marked increase in distrust of State and financial institutions manifested by the Occupy Wall Street protests and distress caused by economic uncertainty.

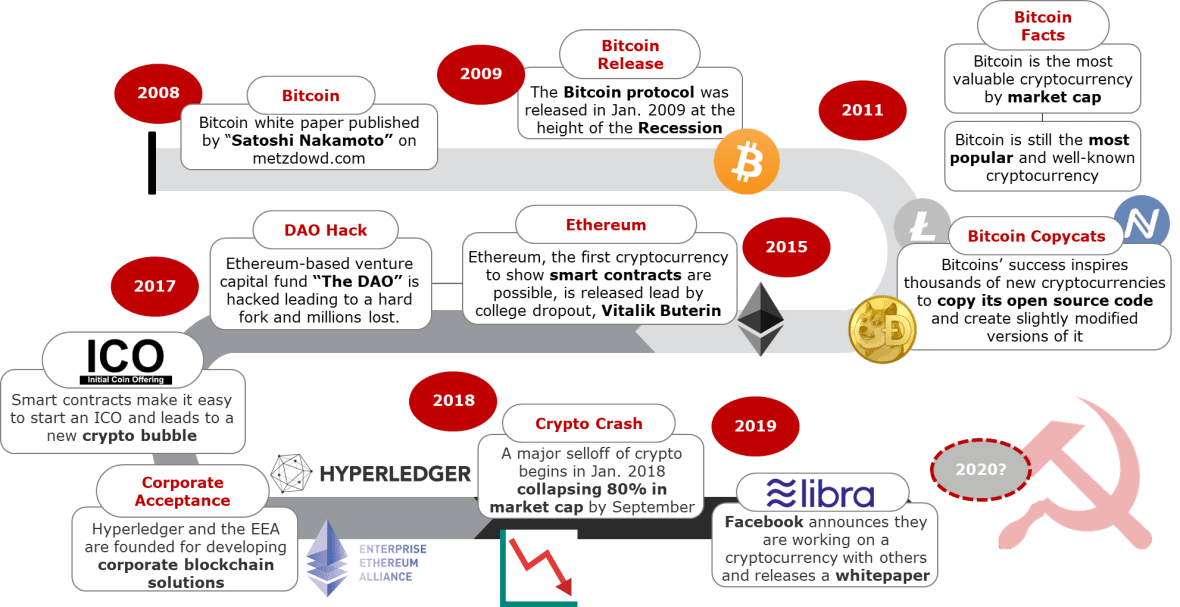

The bitcoin story starts on October 31st, 2008 when a paper authored by a “Satoshi Nakamoto” was posted on a cryptography mailing list called “Bitcoin: A Peer-to-Peer Electronic Cash System.” It described a value transfer system that was not reliant on a central authority like Western Union or any other financial institution by using the internet and a blockchain infrastructure. If it worked, we wouldn’t need to trust the same “too big to fail” banks that gambled average people’s savings on subprime mortgages to hold our money. Of course, at the moment it’s clear that bitcoin has not been able to replace the entire financial system, but it is representative of a deeper yearning from people.

Bitcoin came to be because the technology already existed to make it. It just needed to be arranged in such a way that made it bitcoin. Similar technology was already used to secure centralized digital currency ledgers to make money through complex financial instruments like AAA-rated collateralized debt obligations that turned out to be bunk.

It also came to be because the cracks in the system were on full display as well as the elite’s contempt for democracy and equality. Interest in bitcoin quickly rose after its release showed that people hungered for a financial system which could better represent them. Or at least be an alternative to the one that currently exists. Although there were bumps along the way, and it surely isn’t completely democratic, it inspired thousands of similar projects to improve upon it. What started out as simply a way to send value across the internet without the need of a central entity, has also become a platform for smart contracts, a way to tell computers to perform value transfers based on predefined conditions. Now value transfers can include value beyond money, like voting. Through blockchain, we can now create novel ways to express democracy like conviction voting, liquid democracy, and just making the voting process easier to take part in.

Graphic created by me

At the moment, the same banks and ideology of greed that led to the Great Recession heavily influence the cryptocurrency and blockchain space. We see this particularly with Facebook’s announcement of their own corporate cryptocurrency solution Libra with the backing of a collection of venture capitalists, tech companies, and financial institutions.

History shows that this corporate synthesis can be a threat to creating a more democratic economy and is not something the cooperative movement should take lightly. The cooperative and blockchain spaces have a lot to learn from each other. Projects like Democracy Earth and The Commons Stack are working to improve democracy for the 21st century, including within the workplace by building modular tools on top of blockchain. There are also blockchain projects like CULedger which is working to create blockchain solutions for credit unions and financial cooperatives. Another example is Resonate, a cooperative alternative to Spotify owned by the listeners and the musicians, that is using blockchain to keep track of original works by DJs so they can be directly compensated from users playing their music. I implore cooperatives to make 2020 a year for understanding and exploring blockchain for improving their own internal democracy, promoting transparency, and creating novel ways to engage with each other and their customers, this is just the beginning.

You can learn more about how cooperatives and other democratic organisations could benefit from blockchain here. You can also sign up for the Newsletter and join the r/CryptoLeftists subreddit.

This is a piece of techno-social history I’ve been meaning to write for about a decade, thanks to the author(s) for writing this article and to mutualinterest.coop for publishing it. A couple of things I would include in a brief history tour like this are e-gold, buskware, and the Open Coop’s roundup of cryptotoken projects with public interest goals: https://open.coop/2018/01/25/co-op-coin-ico-look-like/

Regarding contemporary projects that co-ops could work with, I would mention the Open Credit Network, and mutual credit exchange for co-ops based in the UK, and GNU Taler, a free code software project to create a payment platform that can accept payment in a range of forms and protects the privacy of customers (like cash), but without helping vendors dodge taxes: https://nlnet.nl/project/GNUTaler/

A new report from the business-data company looking at the second quarter of venture capital results for global AI startups shows historically strong but declining investing rates for the upstart firms. During a pandemic and widespread recession, this is not a complete surprise; other areas of VC investment have also fallen in recent quarters.